Routing & Account Numbers Guide

Complete guide to understanding and using your banking routing and account numbers for ACH deposits, payroll, payments, and more.

What Are These Numbers?

- Routing number identifies your bank

- Account number identifies your specific account

- Together they enable electronic transfers

- Required for direct deposits and payments

- Used for ACH transactions nationwide

- Essential for modern banking operations

Why You Need Them

- Set up direct deposit for paychecks

- Receive Social Security and benefits

- Pay bills automatically from your account

- Transfer money between banks

- Make online purchases and payments

- Set up recurring payments and subscriptions

When You'll Use Them

- Starting a new job (payroll setup)

- Paying rent or mortgage automatically

- Setting up utility bill payments

- Receiving government benefits

- Making large online purchases

- Transferring money to family/friends

Understanding Your Banking Numbers

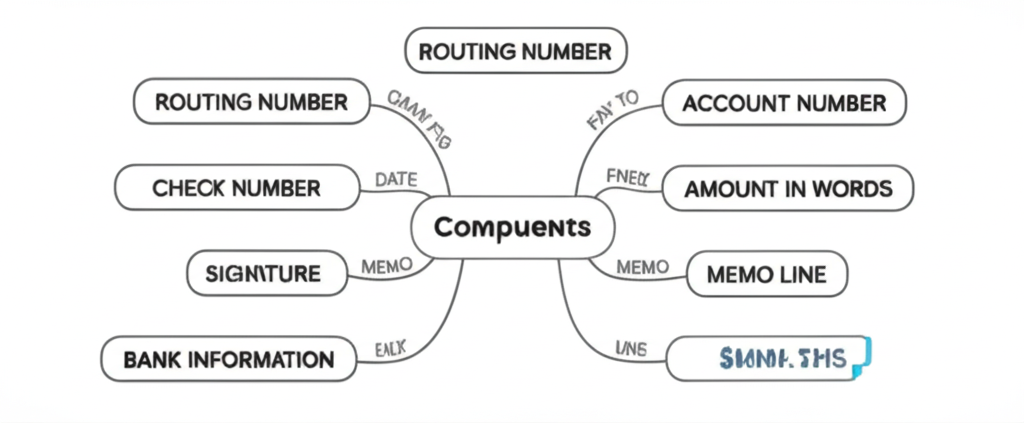

Check Components Mind Map

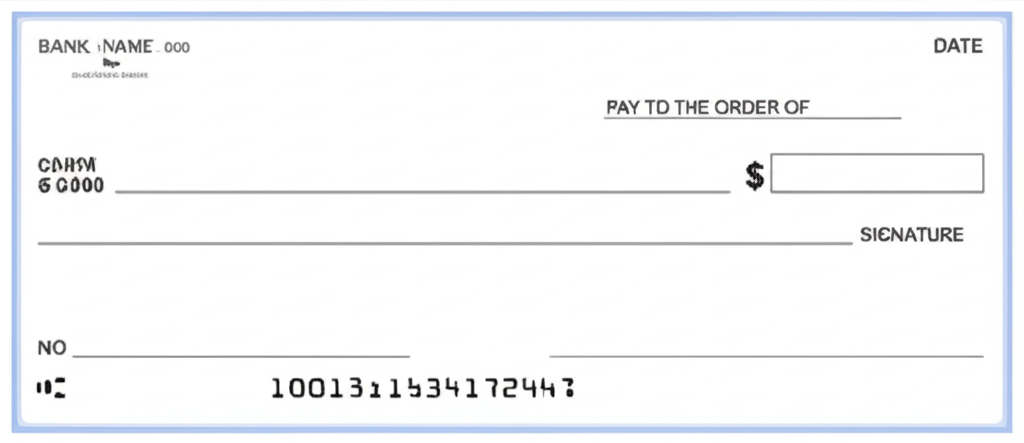

Blank Check Template

Empty check showing where to find your banking information

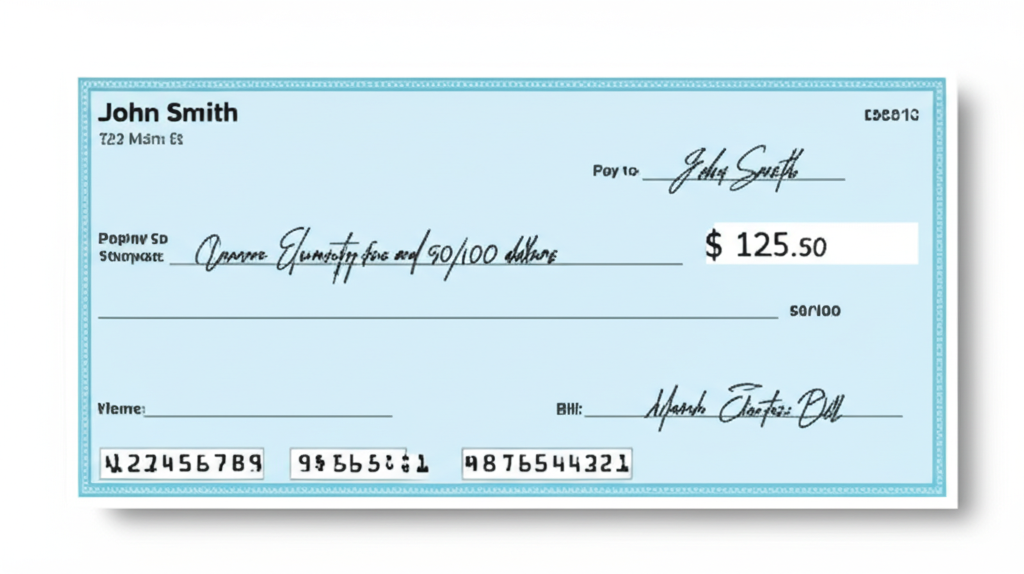

Sample Filled Check

Example with sample information (routing and account numbers highlighted)

Key Points to Remember:

- • Routing Number: First 9 digits at bottom left

- • Account Number: Digits after routing number

- • Check Number: Usually top right and bottom right

- • Numbers are printed in special magnetic ink

- • Same routing number for all customers at your bank

- • Account number is unique to your specific account

What It Is:

- • 9-digit number that identifies your bank

- • Also called ABA or transit number

- • Same for all customers at your bank branch

- • Assigned by the American Bankers Association

Where to Find It:

- • Bottom left of your checks (first 9 digits)

- • Bank statements and deposit slips

- • Online banking account details

- • Mobile banking app

- • Bank's website or customer service

Note: Some large banks have different routing numbers for different states or transaction types.

What It Is:

- • Unique number for your specific account

- • Usually 8-12 digits long

- • Different for checking vs. savings accounts

- • Identifies your account within the bank

Where to Find It:

- • Bottom of your checks (after routing number)

- • Bank statements and account summaries

- • Online banking dashboard

- • Mobile app account details

- • Debit card (sometimes, but not always)

Security: Never share your account number publicly or with untrusted sources.

Using Your Numbers for ACH Transactions

Common ACH Deposits:

Payroll Direct Deposit

Your employer deposits your paycheck directly

Setup: Provide routing/account numbers to HR

Government Benefits

Social Security, unemployment, tax refunds

Setup: Register with government agency

Investment Dividends

Stock dividends, bond interest, mutual fund distributions

Setup: Provide numbers to brokerage firm

Freelance/Gig Payments

Payments from clients, Uber, DoorDash, etc.

Setup: Add bank info to platform

Common ACH Payments:

Automatic Bill Pay

Utilities, phone, internet, insurance

Setup: Authorize company to debit your account

Loan Payments

Mortgage, car loan, student loan payments

Setup: Set up autopay with lender

Online Purchases

E-commerce, subscription services

Setup: Enter bank info at checkout

Investment Contributions

401k, IRA, brokerage account funding

Setup: Link bank account to investment platform

Security and Safety Guidelines

Safe to Share With:

- • Your employer's payroll department

- • Government agencies (IRS, Social Security)

- • Legitimate bill payees you authorize

- • Your financial advisor or accountant

- • Trusted family members (if needed)

Best Practices:

- • Use secure, encrypted websites

- • Verify the recipient's identity

- • Keep records of who you share with

- • Use secure communication methods

Never Share With:

- • Unsolicited phone callers

- • Email or text message requests

- • Social media contacts

- • Door-to-door salespeople

- • Unverified online forms

Common Scam Tactics:

- • "Verify your account" phone calls

- • Fake prize or lottery winnings

- • Emergency money requests

- • Phishing emails from "your bank"

Regular Monitoring:

- • Check accounts daily via mobile app

- • Review monthly statements carefully

- • Set up account alerts for transactions

- • Monitor credit reports regularly

If Compromised:

- • Contact your bank immediately

- • Change online banking passwords

- • Consider closing/reopening accounts

- • File police report if needed

Step-by-Step Setup Guides

- 1Get your banking information: Find your routing number and checking account number

- 2Contact HR or payroll: Ask for direct deposit enrollment form

- 3Complete the form: Enter your bank's routing number and your account number

- 4Attach a voided check: This verifies your account information

- 5Submit and wait: Direct deposit usually starts within 1-2 pay periods

Tip: Keep receiving paper checks until you confirm direct deposit is working properly.

- 1Choose your method: Set up through your bank or the bill company's website

- 2Gather information: Account numbers, routing number, billing account details

- 3Set payment amount: Choose fixed amount or full balance

- 4Choose payment date: Allow 3-5 business days before due date

- 5Monitor first payments: Ensure payments process correctly

Warning: Always maintain sufficient funds in your account to avoid overdraft fees.